Morgan Stanley’s Chief Does Not Get Bitcoin, Calls it ‘Totally Surreal’

For the avid supporters of bitcoin, the digital currency is the gateway to transactions of the future. On the flip side of the coin, the financial institutions do not really know, as of yet, how to deal with this new innovation.

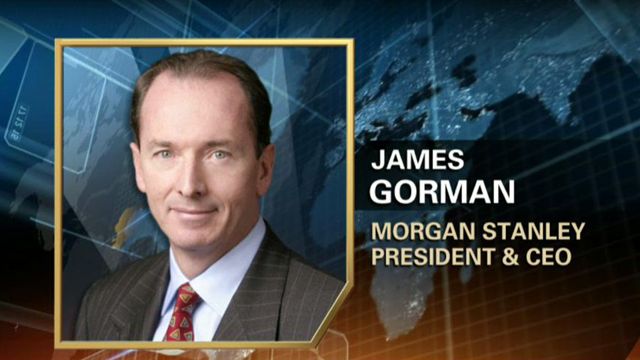

Morgan Stanley’s Gorman Speaks out Against Bitcoin

James P. Gorman, the Chief Executive of Morgan Stanley, stated in a televised interview on March 10th that he did not have a firm understanding of bitcoin. When the Fox Business Network’s Maria Bartiromo asked Gorman about bitcoin, he said “I’m not sure I understand it.”

The digital currency has been in the headlines recently due to the collapse of Tokyo based Mt. Gox exchange and after Newsweek claimed to have found the currency’s maker.

Gorman further continued to call the digital currency “totally surreal.”

“I mean, who’s the founder? This guy in L.A.? What’s going on with Mt. Gox? There’s so many moving parts,” he said.

Additionally, he commented “I would think and hope that the regulators are paying a lot of attention to it.” It might seem a bit ironic that for someone who claims to not understand much about bitcoin is calling for government regulators to pay “a lot of attention to it.”

Dimon Called Bitcoin a “Terrible Store of Value”

Jamie Dimon, Chief Executive of JP Morgan Chase, also expressed doubt over bitcoin and called it a “terrible store of value.” He said that the digital currency can be generated over and over again.

When asked about his thoughts on the digital currency, during an interview conducted with CNBC in late January, Dimon remarked “The question isn’t whether we accept it. The question is, to even participate in people who facilitate bitcoin?”

Further slinging mud at the digital currency, Dimon stated that what he has read from the CNBC news is that the coin is being used for “illicit purposes.” That is a broad generalization to say the least. Just as paper currency is used for a host of things, so is digital currency. To label the coin as being used mainly for illegal activities is a serious misunderstanding.

One can say that paper currency is also used in illegal activities as well and it would be a correct statement. Paper currency has been one of the major suppliers of illegal businesses. But, one would never say that is the purpose of paper currency. Likewise, the purpose of bitcoin is not to fund illegal activities but rather to provide new advancements in the way we make transactions throughout our daily lives.

Helping or Hurting Bitcoin

These announcements from major financial establishments add fuel to the fire. They are not doing anyone a favor by being narrow in their approach to the way they view digital currency. For those who desire for the digital currency to become assimilated into the existing financial system, it would help them to have the support of major corporations. A former officer at the Consumer Financial Protection Bureau, Raj Date, said that “market makers” could help stabilize bitcoin’s volatility. On the other hand, avid supporters of bitcoin view the digital currency as free of the traditional banking system and government involvement.

Bank of America Merrill Lynch appears to be more welcoming to the digital currency. It stated in a report in December that the coin could “become a major means of payment for e-commerce and may emerge as a serious competitor to traditional money transfer providers.” It continued to state “as a medium of exchange, Bitcoin has a clear potential for growth.”

Whether you are for or against it, bitcoin is here to stay. People are continuing to jump on the bandwagon of this phenomenon.

![[Guest Post] The True Use Cases for Bitcoin and Its Role in Banking the Unbanked](https://coinreport.net/wp-content/uploads/2019/04/Ray-Youssef-Paxful-CEO-400x230.jpg)