64% of payment pros don’t see cryptocurrencies as legitimate digital payment form: TD Bank survey

TD Bank branch in Chinatown in Washington, D.C. on 7th street.

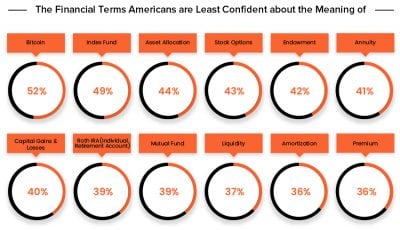

64 percent of finance and treasury professionals do not view digital currencies as a legitimate form of digital payment, according to the recently released results of a survey conducted by TD Bank at the 2018 NACHA PAYMENTS Conference in San Diego, California, back in May.

According to a press release CoinReport received from Prosek Partners, TD Bank’s communications consultancy, 4 percent of the respondents selected controversy around digital currencies as the biggest hurdle facing payments innovation today.

The survey reportedly collected responses from 390 finance professionals on industry trends and outlook.

Other noteworthy findings of the survey include:

- 42 percent of the financial experts surveyed cited incorporation of immediate/real-time payment function within online banking as the leading technological innovation that will have the greatest positive impact on the industry over the next 3-5 years.

- 36 percent cited the need to update legacy infrastructure within corporations and/or smaller banks.

- 20 percent envisage artificial intelligence and machine learning creating positive change in the industry.

Cherry Hill, New Jersey-headquartered TD Bank is one of the 10 largest banks in the U.S., providing more than 9 million customers with a full range of retail, small business and commercial banking products and services at more than 1,200 convenient locations throughout the Northeast, Mid-Atlantic, Metro D.C., the Carolinas and Florida. The bank is a member of TD Bank Group and a subsidiary of The Toronto-Dominion Bank of Toronto, Canada, a top 10 financial services company in North America. The Toronto-Dominion Bank trades on the New York and Toronto stock exchanges.

Image credit – ‘Matthew G. Bisanz (CC BY-SA 3.0)