The Price of Bitcoin is Not the Point

Bitcoin is crashing, and that’s okay.

Bitcoin is crashing, and that’s okay.

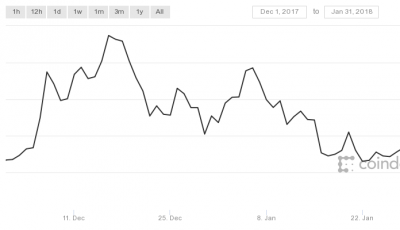

Earlier this week, the price of Bitcoin dived precipitously, reaching lows not seen since Bitcoin’s last big crash. At time of writing, the price is below $500, the lowest level since May. There’s a decent chance it’ll fall a lot farther before this crash is over. If this surprises you, it shouldn’t. The majority of bitcoins are held speculatively, and only a small fraction of all Bbtcoins spent are actually been used to pay for goods and services (as opposed to other currencies in an attempt to exploit temporary arbitrage). One million dollars worth of Bitcoin change hands every hour. Common sense tells us that that does not reflect a million dollars worth of purchases of goods and services – Overstock.com, likely the largest and most-used Bitcoin vendors, makes less than a thousand dollars an hour on Bitcoin purchases. The market price exists at the pleasure of a few hundred thousand nervous speculators playing a near-zero-sum-game, many of whom are just trying to get out while the getting is good.

With some notable exceptions, the price of Bitcoin has been on a downward trend since its peak at $1135 near the end of last year. It will probably go lower as speculator fatigue sets in, and the price comes to reflect the actual demand (which itself reflects the purchasing power of Bitcoin). The purchasing power is growing, of course, but it’s still nowhere near enough to sustain the prices we’ve become used to. Bitcoin is not going to the moon. Not any time soon, anyway.

Now for the good news: literally none of that matters. Or, at least, it shouldn’t. Every time the price of Bitcoin drops closer to its market equilibrium, stability increases. It becomes easier to hold onto Bitcoin for a few weeks or a month without having to worry about what the price is going to be tomorrow. That brings us closer to a place of stability, from which sustainable growth backed by real commerce can occur. Bitcoin falling to reflect real market value is healthy in the long run, and makes it easier to build interesting things on top of the platform.

Now for the good news: literally none of that matters. Or, at least, it shouldn’t. Every time the price of Bitcoin drops closer to its market equilibrium, stability increases. It becomes easier to hold onto Bitcoin for a few weeks or a month without having to worry about what the price is going to be tomorrow. That brings us closer to a place of stability, from which sustainable growth backed by real commerce can occur. Bitcoin falling to reflect real market value is healthy in the long run, and makes it easier to build interesting things on top of the platform.

For those who are interested in Bitcoin’s long-term potential to revolutionize finance, bring the international economy to the developing world, and enable a private, efficient and voluntary market free from invasive regulation, the price of Bitcoin is a sideshow. Making money was never the point. Unfortunately, a large portion of the Bitcoin community is comprised of speculators, people out to make a quick buck. From them comes the panicking every time the price drops by another factor of two. There’s a whole population of day traders hoping (generally unsuccessfully) to profit on the swings of a commodity they may not fully understand.

In due time, Bitcoins (or their replacements) may prove very valuable. It’s easy to compute the price of Bitcoin if we denominate a few percentage of the world economy in it. It’s enormous, and maybe it’ll get there one day — but it’ll be a slow process, and right now we aren’t even close.

The least interesting thing you can do with Bitcoin is invest in it. It’s time we came to appreciate that and allow the market to reach equilibrium with a minimum of tears. The future of money is moving up in the world regardless of its price, and you don’t need to get rich quick to appreciate that.

BS!! Falling to reflect real market value? Your an idiot the price dip went to 360 in may on more than 1 exchange. this time its only btc-e and some twisted shit happened .. why would someone sell automatically for $100 less than what btc is asking for

Big boys are gaming the system trying get low starting positions.. the only thing good you said was that price didnt matter.

You mustn’t scare the herd. Tell them it’s not the point when the price is tanking!

Tomorrow, if it goes up, you can say we’re prepared to go to the moon.

Your assessment is spot on. The value of bitcoin has been loaded with speculation bloat. In the long run, crypto will revolutionize money as we know it. I’m not even sure it will be bitcoin. It certainly has it’s disadvantages.

This is why I like bitcoin and the whole cryptocurrency world. Bitcoin opened an era never seen and thought before. I, for example, can trade crypto currencies now and I can benefit from their volatility. I used to do financial forecasting and now I enjoy doing crypto forecasting on http://www.cryptofactsheet.com using ARMA-GARCH and Monte Carlo simulation tools. With an accuracy direction of almost 80% one can think good strategies for doing good money. Bitcoin opened a new world and one could take advantage of it. However, one should not touch it before learning it and understanding it very well. Big volatility means big opportunities, but also big losses.