Previous Story

Fintech firm Funderbeam releases ICO trends report

UK-headquartered investment and trading platform Funderbeam has released an industry report detailing ICO trends.

UK-headquartered investment and trading platform Funderbeam has released an industry report detailing ICO trends.

Funderbeam was awarded the Best European Fintech Company 2017 award at the European Fintech Awards in Brussels early in October this year. A pre-conference event of the awards ceremony was held at the European Parliament.

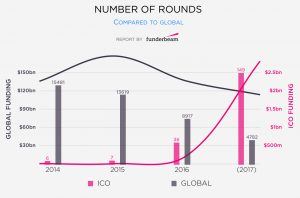

According to the company’s ICO Funding Report:

- ICO funding began gaining traction in 2016 and exploded in 2017, where the funding increased from $228m to $2,8bn. The number of rounds has quadrupled and is nearly reaching 150.

- Whereas worldwide funding has been decreasing a little over the last few years, ICOs have had a huge increase in funding. The same trend continues with the number of rounds. Whereas worldwide the rounds have been decreasing faster than the rate of total funding, this year ICO rounds have jumped to an all-time high.

- Although the funding amounts are really different on a worldwide scale compared to ICO funding, the average round-sizes are quite similar and follow a trend of increasing round sizes. The average ICO round-size is nearly $19m per round, whereas funding in all round types is nearly $24m per round.

- Europe excelled in 2014 with the highest average round. But so far in 2017, North America and Asia, relative to Europe, have rounds almost twice as large. In North America, the average ICO round-size was $31,5m in 2017, in Asia it was $30,7m and in Europe $16,7m.

- ICOs are producing much larger rounds than both early-stage funding (angel, seed, crowdfunding) and even Series A+ funding. Average ICO round-sizes in Europe are the highest relative to all other stages of funding.

- Out of all regions, North America has the most funding raised by ICOs, almost twice as much as in Europe. The overall share of total funding raised by ICOs is almost twice as high in Europe reaching 3,83% compared to just 2% in North America.

- In Europe, Switzerland has witnessed the highest number of ICOs, with a total of 13. This is just ahead of the UK, which had 8 ICOs and a total of $71m in ICO funding. Overall, mostly Western European countries have begun adopting ICOs, one exception being Estonia with an impressive 4 ICOs from the tiny nation.

- The United States is ahead of the pack as the country with the highest amount of funds raised through ICOs, but only 0,45% of the total startup funding is raised through ICOs in the country. Out of the top 10 countries with ICO funding, Estonia has the highest percentage of its overall startup funding raised by ICOs. Out of the total $240m, 28% was raised by ICOs.

- The vast majority of the firms raising funds through ICOs belong to financial service and cryptocurrency sectors. Outside of these, there’s been a large number of gaming firms, as well as ones that belong to big data, AI and media sectors.

The full ICO Funding Report can be downloaded from here.

Image courtesy of Funderbeam via PR firm Blonde 2.0