New global finance platform to offer small firm loans of up to €1m in as little as 24 hrs.

Lithuania-based startup Debitum Network has launched a worldwide finance platform, known as Abra 1.0, that will deliver loans of between 10,000 euro and 1 million euro to small businesses in as little as 24 hours, according to a press release CoinReport received from Blue Oceans PR, Debitum’s communications firm.

Lithuania-based startup Debitum Network has launched a worldwide finance platform, known as Abra 1.0, that will deliver loans of between 10,000 euro and 1 million euro to small businesses in as little as 24 hours, according to a press release CoinReport received from Blue Oceans PR, Debitum’s communications firm.

The launch was announced at the World Blockchain Forum in London, UK.

The platform allows investors from all over the world to finance short-term loans to small businesses. The loans will be delivered through a self-contained ecosystem that includes service providers like insurers and risk assessors.

The system launches with an investment portfolio of 500,000 euro, and is planned to roll out in 15 countries by next year.

Debitum Network’s Abra 1.0 platform offers flexible small business loans of up to 1 million EUR

Debitum Network’s Abra 1.0 platform offers flexible small business loans of up to 1 million EUR

Debitum Network says in the news release its solution is founded on a unique hybrid model that brings together the best features of conventional loaning and digital currency transactions. Blockchain technology powers the internal processes of the system (using the Ethereum-based DEB token of the platform), while conventional fiat currency is used to deliver loans. As a result, the system unites end-to-end security and transparency in a user-friendly manner.

It is because of blockchain technology that Abra 1.0 is able to deliver loans that quickly (in as little as 24 hours – a fraction of the time taken by conventional banks).

Investors of all sizes can benefit from investment opportunities presented by the platform, with individual investments beginning from as little as 10 euro and going up to a maximum of 10 million euro. The investors get returns of 10-15%.

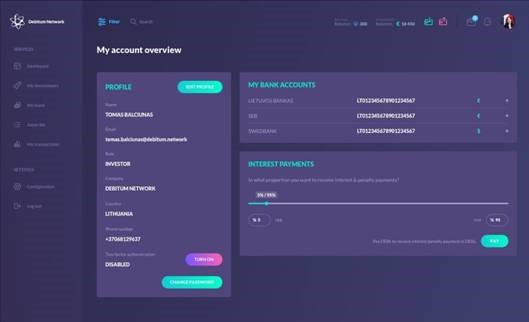

A central dashboard enables the investors to keep track of their investments. Through a simple interface, the loaners can see at a glance how much profit they have earned and see potential investment opportunities, ranked according to risk.

A simple dashboard enables investors to track their investment portfolio at a glance

Abra 1.0, says the release we received, represents a momentous milestone in dealing with a grave worldwide problem. According to the latest World Bank numbers, approximately 70% of small and medium-sized enterprises (SMEs) the world over cannot secure the investment they require from conventional banks. Risk-averse loaning, unwieldly rules & regulations and bureaucratic processes have increasingly made the traditional banking industry incapable to attend to the requirements of SMEs for flexible, short-term loaning, leading to a boom in alternative finance choices expected to top $90 billion by 2020.

Images via press release

![[Guest Post] Breaking Down Barriers with The Next Generation of DApps](https://coinreport.net/wp-content/uploads/2019/06/Jimmy-Zhong-CEO-of-IOST-400x230.jpg)

l am looking for a.loan of $5000 to assist me purchase some machinery from China to help me expand my African Gourmet Food manufacting company in Accra Ghana. l see intend to pay back in 24 months without fail. let me know the modalities to follow to enable me secure the loan. Thank you for your cooperation and hope to read your response very soon.

Regards

kwasi Entwi Quarshie

Accra

Ghana