A conversation with Chris Kitze, CEO of Safe Cash [Audio + Transcription]

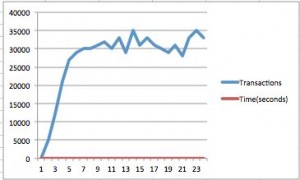

Last month, Safe Cash Payment Technologies, Inc. announced that its blockchain can handle up to 25,000 transactions per second, or 3,000 times the number of transactions that bitcoin’s blockchain can handle. In other words, this payments technology company now has the world’s fastest blockchain.

Last month, Safe Cash Payment Technologies, Inc. announced that its blockchain can handle up to 25,000 transactions per second, or 3,000 times the number of transactions that bitcoin’s blockchain can handle. In other words, this payments technology company now has the world’s fastest blockchain.

I had the pleasure to speak with Chris Kitze, founder and CEO of Safe Cash about their accomplishment. In the audio recording below, you can hear our discussion about Safe Cash’s transaction time and its mission to give people across the globe access to free and quick money transfer services.

Below you can read the full transcription of our conversation.

Carlo: I wanted to know if you could go into more detail about the transactions per second I mean 25,000 per second that’s pretty incredible.

Chris: We think that’s just a starting point. That benchmark test was run on a single i7 processor… 16 gigs of RAM, and it probably had a 1 terabyte SSD or to 40 gigabyte SSD. It costs about $900 and it’s about 25000 transactions per second and that’s only on one thread. Now if you remember there are 4 cores and 8 threads in an i7 processor.

Now you have to keep in mind, this is a private blockchain. So it’s not a blockchain that is out, distributed out and [where] everyone gets to run a little piece and all that. There are a number of factors, that is one of them. There are a lot of other things that have to go through the blockchain. We started out with the Litecoin [and] Bitcoin code base and that was about 2 years ago. We found a bunch of security problems and also looked at it from the point of view of performance. You can see right now the issue with that bitcoin’s going to have – we love bitcoin [and] we think it’s a great technology – but the issue that it’s going to have is… it’s going to have scaling problems and you have a governance problem right now.

People are playing fenders with somebody’s money, that’s all you can say. I’m hoping that people wake up and just realize to not be selfish about things and just say “Well, let’s do something for the good of the community and do the right thing.” At some point Bitcoin is going to have to scale. There’s 25,000 transactions a second [which] includes [a] two second final settlement, so it’s not like you have to wait for the initial confirmation for 10 minutes for Bitcoin and then another hour for it to settle… 2 seconds for the whole process. You get your coin and 2 seconds later you can send it off to someone else, that’s really cool.

Once people start seeing this with currencies – there are benefits to bitcoin of course, too, I’m not going to say anything bad about bitcoin – But when you see how fast things can be, people will immediately say “Well, why [aren’t other currencies] as fast as this? We’re hoping it inspires people with different currencies to start looking at the performance because part of the reason why people are not using the technology is quite simply because it doesn’t scale. People look at it, they’ll bring it in for a test and they’ll look at it and they’ll say “wow, yeah it’s pretty cool.”

It does a lot of these things, there are some weaknesses to it, there are things that they don’t like, but the real problem is if you got a giant bank. Let’s say you’re running the ACH Network in the U.S. They did 5 billion transactions last quarter, trillions of dollars, and it works. It’s slow, it takes about 2 or 3 days before you get final settlement day in and day out… Right now if you think about it, if you [complete transactions] over an 8 hour day, they’re processing the equivalent of around 3,000 transactions a second. So [if] you’re going to have to be able to start talking to people, you need twenty-five to fifty thousand transactions a second as your opening bid. Keep in mind this is the blockchain itself just being able to grind the transactions sooner.

The blockchain in our system is actually only between 5 and 10% of the code base, so there’s a whole bunch of other stuff. The goal is of course, you push as much of it out to the edge of the net as possible to the wallet.

Here’s my iPhone, it’s an iPhone 6 Plus, that thing has 8 cores. It’s more powerful than the quarter-million-dollar servers I used to buy 15 years ago, and it’s in the palm of your hand. This is why you can generate these very strong and powerful keys. You combine that with the network, you combine that with people now being able to understand this kind of concept, and all of the sudden people are going to be “Why do I need to go to an ATM? I don’t need an ATM anymore. Why can’t I just send money to my friend in Peru or in Japan or wherever? And I want it to go to them instantly and I don’t want to pay a fortune.”

When you look at the banking system, the way it’s configured today, the payment rails in the banking system today, they work. Let’s face it, trillions of dollars move through the banking system. You’ve got something that works. The problem is [that] it’s just too slow. We’re actually on the Federal Reserve Faster Payment Task Force, and so that’s one of our objectives, to help the banking system to do things faster, to give consumers more choices to let consumers use their money in new and innovative way, for spending and sharing and sending… and to do it very efficiently.

That’s why we’ve been working on this. We’ve been working on it for about 2 years and it’s been really exciting. Part of it is, you don’t get the chance to change the payment rails but every maybe 50 years. You went from gold bars to wires back in the ’50s, basically, and here we are maybe up to the ’70s you got some innovation, you got the card networks come in and all those things, and now here we are today. So the real question is, the innovation, I’ve just been talking about the fiat currencies, but they were a whole other classes of currencies that will exist that are going to be, I think, really exciting for people. First, you’ve got loyalty, these are things where you can [incentivize] people and you can help to reinforce a network.

If you go to our website, get a free account at safe.cash… you can get a free account, get some coins… go tell your friends to get an account and then just get on the phone and send tokens back and forth to each other and you’ll see what 2-second settlement is like. It’s kind of like the difference between riding on a jet compared to a moped. It’s really astounding. People like fast. Who wouldn’t want to ride in a Ferrari? You don’t wanna be in a horse and buggy, you wanna be in a Ferrari. When you send an ACH you really feel like you’re in that horse and buggy a little bit. It’s kinda slow. It works and you’ve got the bank who you can trust usually, backing [your accounts]… banks are generally good.

You have a lot of other issues, too. These are people who, by choice or by design, they… can’t get a bank account. There are millions of people who’ve been in jail in the US – I mean the U.S. jails more people than anyone else in the world – can those people get a bank account? No, it’s very difficult for someone to be able to get a bank account. So what do they have to do? They gotta pay Western Union. If you want to send $100 to Mexico to your relatives or your friends, it’s $8. If you want to send $100 from California to New York with Western Union it’s $12. It’s even more expensive to go to New York then it is to Mexico. When I heard that I was kind of shocked about that. There’s something wrong about this when you charge that much to a poor person to help them use their money… It’s not just Western Union, it’s all of them – I’m not saying anything bad here about Western Union, – I’m just saying that’s just the system and way it is. I’m really hopeful that we’re gonna be able to give people choices.

Carlo: How has the reception been since the press release came out last week?

Chris: It’s been very good, it’s been very positive. Some people are like, “How did they do this?” We got a few of those… The banks are looking at this seriously now. We’re under nondisclosure with a bunch of big companies and big banks, but I think really what it comes down to… They’re looking at the capability of being able to do it.

We’re now being invited into conversations that we were not being invited into before, or people frankly didn’t hear about us because we are kind of working in obscurity for the last 2 years. So now we’re pushing this news out there and showing people what we can do. You can go to the website and you can actually see a demo with Unity. The advantage of that, of course, it’s a loyalty token so you don’t need a KYC, there’s no AML because there’s no value.

When you think about Unity, when you have a token that can process that fast and in that kind of volume, now all of the sudden it’s practical to do things like put in a digital stamp of like one Unity token which could be worth a thousandth of a penny, put it on an email and there’s your stamp. So you know where it came from. What [that] does is… if I want to send an email to Yahoo I just throw us a thousandth of a penny on to it and guess what? Anything that comes from my account is going to go through and they’re going to be able to say this is spam or this is not spam. The person who receives it is going to get the token back. If they get a thousand emails, they send a thousand emails, they’re net zero. It hasn’t cost them a penny, it hasn’t cost them anything, and it’s this kind of social good that we think is going to come from a product like this. That’s really the goal with Unity and I think that’s the next thing I think people are going to start looking at. Our kind of thinking about this stuff is a little different.

A lot more people are looking into this and saying “oh, this is kind of an interesting concept.” Our concept is “what if a block chain cost $49?” What kind of things can you do with a blockchain? What if you had an application and you wanted to just do something with it and you wanted some tokens to go play with, to go build an ecosystem around your application, and those tokens could be compatible with a lot of other things? That’s kind of the concept behind Unity.

Our goal isn’t to try and keep 10% of the coins for ourselves and hope the price goes up. We’re actually not going to keep any coins for ourselves. We’ll have some announcements about that in the future but we don’t think that’s right. We think the profit model should not be on the coins and, in fact, there are legal clarifications about that, too. I think the main thing is that if we build an ecosystem and everyone can find a way to benefit and profit from this… if you contribute something to this, you should get something back out. It’s just really that simple. And if someone else can come in, it’s just following gain and loss. If you gain something you’re going to lose, if you lose you’re going to gain. That’s how it should work.

Images courtesy of Safe Cash via SocialRadius

![[Guest Post] Breaking Down Barriers with The Next Generation of DApps](https://coinreport.net/wp-content/uploads/2019/06/Jimmy-Zhong-CEO-of-IOST-400x230.jpg)