CoinTerra files bankruptcy petition

CoinTerra – an Austin, Texas-based company that sold Bitcoin mining computers – has begun the process to liquidate its assets with a Chapter 7 bankruptcy filing, reports the Austin Business Journal.

CoinTerra – an Austin, Texas-based company that sold Bitcoin mining computers – has begun the process to liquidate its assets with a Chapter 7 bankruptcy filing, reports the Austin Business Journal.

Filed on Saturday, CoinTerra’s bankruptcy petition states that between 200 and 399 creditors are owed between $10 million and $50 million. Assets are reported to be between $10 million and $50 million, but CoinTerra told the court that unsecured creditors will likely not be paid, said the Austin Business Journal.

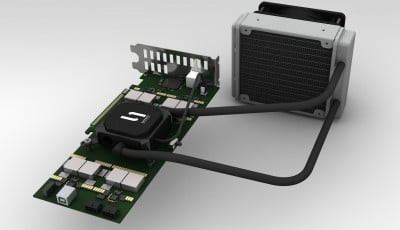

Launched in 2013, CoinTerra developed what it called high-performance “bitcoin application specific integrated circuits and systems,” and was funded with at least $2 million from dozens of investors.

The Austin Business Journal said that in June, the Better Business Bureau reported that some CoinTerra customers were unhappy with the firm, arguing that its Bitcoin mining computers did not meet specs CoinTerra promised and that it has not refunded customers who wanted their money back as a result.

The news outlet noted that CoinTerra’s website has gone static and its Twitter account has not been active since early September.

CoinTerra CEO Ravi Iyenger did not sign the bankruptcy petition, said the Austin Business Journal. It was submitted by Sunny Kalara, who is listed as an “authorized representative.”

Earlier this month, CoinDesk, which spoke to Iyengar, reported that the company is in default on approximately $4.25-million worth of secured notes. Iyengar made the admission after his company became the target of a lawsuit filed by data center services provider C7 Data Centers. CoinTerra has filed a countersuit, contesting C7’s claims of unjust enrichment and breach of contract.