[Guest Post] Security Token Offerings Part 1: An Introduction

by Trent Rhode

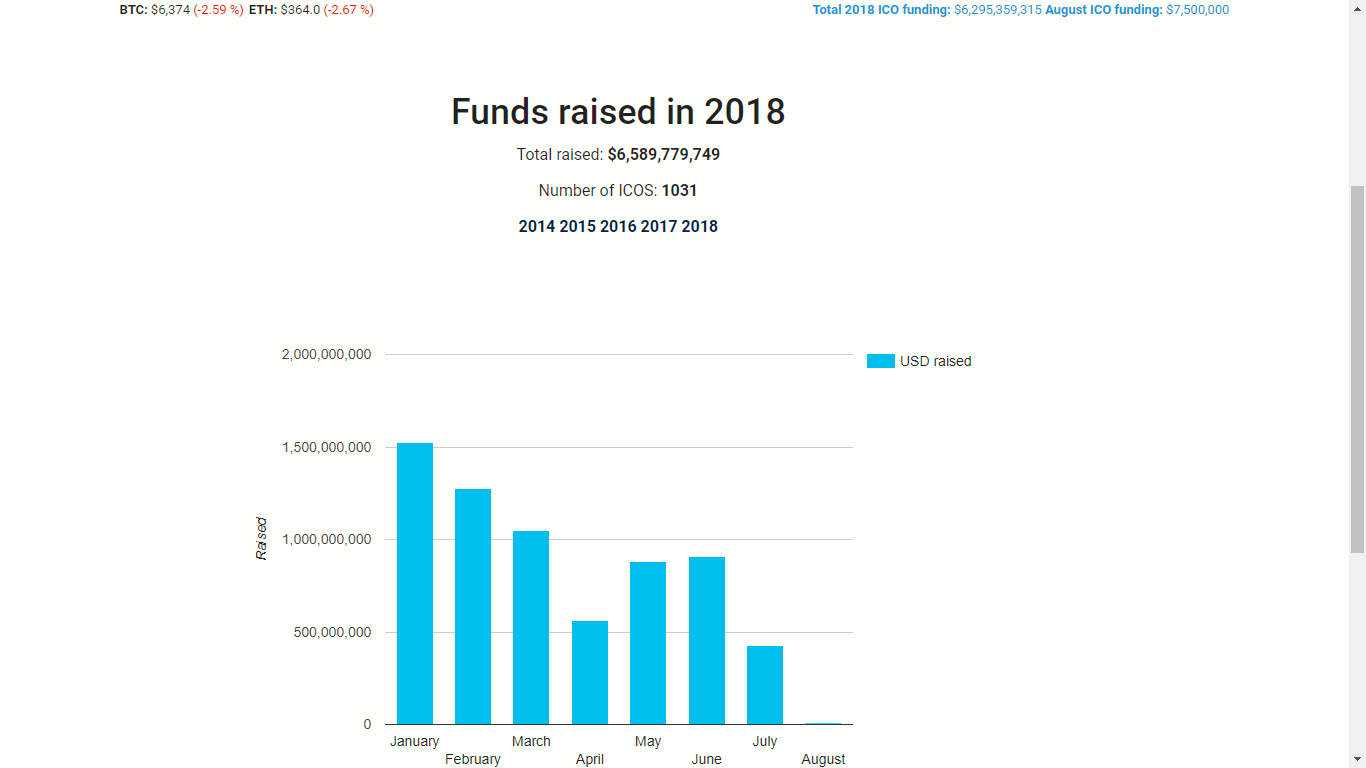

So far, 2018 has seen a massive cryptocurrency market crash, while ICOs have declined significantly in the amount of money they are raising. This might just be a regular market cycle, but it may be no coincidence that the downturn in markets and ICO investments has coincided with a clamping down on ICOs by lawmakers and an international uncertainty in crypto related finance and trading regulations.

(Image Source: ICOdata)

It may also be no coincidence that the late July cryptocurrency market upturn came soon after some positive news on the regulatory front, including the SEC ruling that Bitcoin and Ethereum are not securities, and the potential upcoming approval of a Bitcoin ETF.

Whatever happens with ETFs and other regulatory hurdles for cryptocurrencies, one thing is clear: more regulations are coming, both in the US and internationally.

The aim of this four-part series is to explain why becoming aware of and taking advantage of security tokens and Security Token Offerings (STOs) is probably one of the most important ways we can prepare for this increased regulation. If taken advantage of, these new more decentralized fundraising mechanisms could form a key component of a more fair and decentralized economy in general.

Security Tokens and STOs

First of all, securities are defined as contractually based tradeable financial assets. Security tokens are blockchain-based, cryptographically stored digital assets that allow investors to own a tradeable financial asset. That can be anything from a physical backed asset (e.g. gold bonds), to shares in a company that pay dividends.

STOs are digital investment offerings that issue security tokens, either registered with, or exempt from registration with regulatory bodies in the country of issuance. Technically, an STO’s legal name would actually be whatever legal designation it falls under (e.g. Regulation D or Regulation A filings with the SEC in the United States). Just because STO contracts are digital and on a blockchain, it doesn’t mean they have separate classifications in a given jurisdiction over traditional investment offerings.

To get a hint of why many experts are calling security tokens and STOs the next big opportunity in traditional and alternative trading markets, we only need to look at what regulators are saying about the existing cryptocurrency markets as they stand.

The Problem with ICOs

SEC Chairperson Jay Clayton has said on more than one occasion that although he sees great promise in the technology, the SEC will not stand for the current way ICOs are conducted and their tokens traded. This is why most ICOs simply don’t offer token sales in the United States anymore (at least for non-accredited investors), with many of them also opting out of South Korea and Japan.

The problem: in theory, there are “utility tokens” and “security tokens”, with most cryptocurrency projects referring to their tokens as utility tokens designed to offer holders a way to participate in their network in some way (e.g. a mechanism for users of a web browser to pay publishers without ads).

However, many of these tokens are still used to raise money for projects with the expectation of a return on investment for investors who then trade them on secondary markets. Clayton therefore considers them securities that should be regulated, even though they don’t convey holders ownership rights of any kind.

“A token, a digital asset, where I give you money and you go off and start some venture…and in return for giving you my money, you say, ‘You know what? I’m going to give you a return’, or you can get a return in a secondary market by selling your token to somebody… That is a security and we regulate that. We regulate the selling of that security and we regulate the trading of that security. That’s our job, and we’ve been doing it for a long time,” said Clayton in a June 2018 CNBC interview.

In other words, in the United States, it doesn’t matter if the entity selling the token explicitly states that they are raising money to fund their venture, and it doesn’t matter if the token conveys ownership rights. A token is a security if anyone, whether a third party or the entity itself is providing a way to speculate on the price of the token.

Work arounds like giving away tokens for free in “FreeCOs” and “Airdrops” also do not address the issue of how tokens are exchanged on unregulated exchanges, and how distributing tokens for free is designed to get exposure for the token with the intent to raise its value. Since the entities giving away tokens in this manner typically keep some of them to later sell on exchanges, this makes the intentions of such projects to raise money through these means clear.

Now, the SEC and other regulators are not saying that digital securities are a no-no. They are merely saying they must be registered or exempted from registration under specific guidelines that include various investor protections. This might not be such a bad thing for investors.

Indeed, if combined with more traditional investor protections and higher quality business plans, STOs have the potential to change for the better not only the way blockchain-based fundraising works (i.e. ICOs), they can also change for the better how international investment and finance in general work.

In part 2 of this series, we’ll take a deeper look at why ICOs have failed in this regard, and how STOs may hold promise for inspiring such an evolution.

Author Bio

![[Guest Post] Security Token Offerings Part 1: An Introduction](https://coinreport.net/wp-content/uploads/2018/08/Unhashed-author-Trent-Rhode-150x150.png)

Trent Rhode

![[Guest Post] The Lost Treasure of Quadriga CX: A Teachable Moment](https://coinreport.net/wp-content/uploads/2019/03/Patrick-Burke-Photo-400x230.jpg)

![[Guest Post] Major Issues Canadians Face when trying to Invest in Crypto](https://coinreport.net/wp-content/uploads/2018/12/CoinSmart-co-founder-CEO-Justin-Hartzman-400x230.jpg)