[Guest Post] With Banks Banning Cryptocurrency Purchases on Credit Card, What Should Your Next Step Be?

By Harsh Agrawal

Recently the cryptocurrency world received a jolt of sorts, when several major banks decided to ban the purchases of virtual currency using Credit Cards.

Recently the cryptocurrency world received a jolt of sorts, when several major banks decided to ban the purchases of virtual currency using Credit Cards.

Bank of America, Citigroup, Lloyds Banking Group, Virgin Money, JPMorgan have all halted cryptocurrency purchases made on Credit. Even Commonwealth Bank has put a stop on customers buying cryptocurrency citing that the purchases are no more “appropriate.” Several other top financial institutions too followed suit and announced bans/impending bans on the virtual currencies.

This news is a shocker for many, especially those who wanted to hop on the cryptocurrency bandwagon using this method of payment.

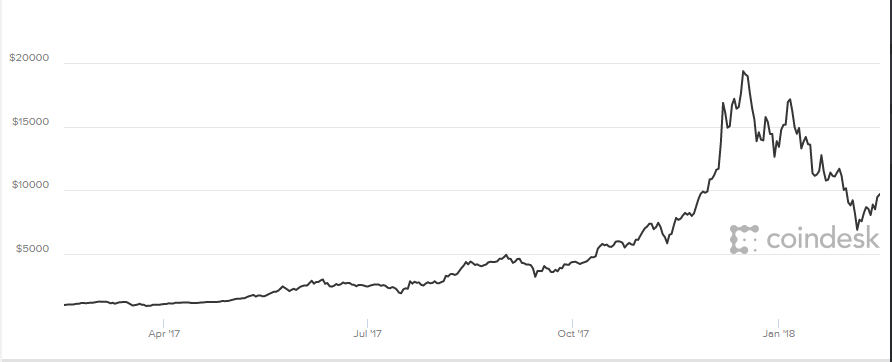

The step by banks came on the heels of the volatility of digital currencies such as Bitcoin, which did not go unnoticed by the financial institutions! The risks that accompany the cryptocurrencies were highlighted by bankers and the World Bank even went on to compare it to “Ponzi schemes.”

Image: https://www.coindesk.com/price/

That said, the moves by the banks are all in the favor of the financial institutions’ self-interest.

The cryptocurrency boom had led investors to resort to credit cards for buying the coins. As a result, they ended up buying more currency than what they could actually afford. They used the cards to fund their accounts on online exchanges and could buy as many coins as they wanted without any hassle and probably without thinking about the possibilities of the “bubble” bursting.

With the price of the coins falling down drastically, many of them will be unable to pay off those purchases in the near future.

And that’s where the banks’ fear stand true.

More or less, all of them are concerned about the perils that come with letting people invest in a volatile asset and that too at credit card interest rates. The peril increases manifold in this case because there’s no way to retrieve the money, when the virtual coins are placed in an anonymous wallet!

Another potential problem that may arise is that stolen cards can be used to purchase the currency. Surely, no bank or customer would want that to happen!

The difficulty of monitoring these currencies is one more headache for banks as it will be difficult to monitor the customer transactions.

On the flipside, this decision led to further sharp falls in the price of coins and thus, leaves some of the customers with more debts. In the process, it creates more risks for the institutions!

With the banks’ decision, one of the doors for purchasing coins just got closed! So, where does that leave scrupulous investors? The solution is not that complex.

The Next Steps for Cryptocurrency Buyers

Bitcoin or altcoins need no permission to buy or use. However, with many countries making them illegal, the legal status of the virtual currency is the prime factor that you need to take into consideration before making a purchase.

Banks too, have no qualms when customers use their own money to invest in the virtual currency, letting them use debit cards and transaction accounts.

The CBA in a statement said “Due to the unregulated and highly volatile nature of virtual currencies, customers will no longer be able to use their CommBank credit cards to buy virtual currencies. This will come into effect as of 14 February 2018. Our customers can continue to buy and sell virtual currencies using other CommBank transaction accounts, and their debit cards.”

It further added, “We have made this decision because we believe virtual currencies do not meet a minimum standard of regulation, reliability, and reputation when compared to currencies that we offer to our customers. Given the dynamic, volatile nature of virtual currency markets, this position is regularly reviewed.”

Apart from purchasing cryptocurrency using debit cards and bank transfers, you can also get them from a Bitcoin ATM, use PayPal or simply via cash deposit.

A bank transfer will help you buy large amounts of bitcoins and will require the lowest fees. It will also take days to complete the transaction. Coinbase is one of the best options for this.

Talking about cash, it is the fastest and a more private option to buy virtual currency. More often than not, you should be able to receive the coins within hours of the purchase. The only drawback is that the cash exchange currencies have a price that’s 5-15% higher than the market rate.

The Bitcoin ATMs are another alternative, which you can explore by inserting cash and getting the cryptocurrency sent to your wallet. The caveat is obvious. These special ATMs are not present everywhere, even though they offer a convenient way of buying cryptocurrency.

The next option is PayPal. However, merchants are not allowed to sell bitcoins for it and hence, you can’t directly purchase cryptocurrency with it. The fees are high and anyway, it will be linked to a bank account, which will help you do the same at a lower cost!

Wrap Up

The ban on buying bitcoins, altcoins or any other form of virtual currency on credit was a bid by banks to safeguard themselves. But that shouldn’t deter you from choosing the next best option. What say?

Author Bio

Harsh Agrawal

Harsh Agrawal is passionate about Blogging and Blockchain technology. His belief is, Blockchain technology can bring much needed social change. He shares his learning on CoinSutra (A crypto community), whose mission is to help Individuals master Blockchain technology and cryptocurrency economics.

![[Guest Post] The Lost Treasure of Quadriga CX: A Teachable Moment](https://coinreport.net/wp-content/uploads/2019/03/Patrick-Burke-Photo-400x230.jpg)

![[Guest Post] Major Issues Canadians Face when trying to Invest in Crypto](https://coinreport.net/wp-content/uploads/2018/12/CoinSmart-co-founder-CEO-Justin-Hartzman-400x230.jpg)

Get online appnana generator from here without spending a single penny.

We cannot force others to believe unto something other people believe. Like in Cryptocurrency, some takes this negatively, while others, it makes life easier. To know more about Cryptocurrency industry, Killer Whale http://killerwhale.io

can provide you careful counseling and market guidance regarding this.

Good insight and knowledge on the latest updates on cryptocurrency purchases credit card next step for banks banning. Thank you for sharing this information. It was very helpful.

https://www.mixbtc.io/

Mixbtc.io was created for the bitcoin mixer community with three things in mind, trust, speed, and security.

We understand that using a bitcoin mixer for the first time can be uncomfortable so we recommend splitting larger transactions into multiple ones until you’re comfortable with the process.

Invite to Crypto Traders 365 Blog, your number one source for all features of Cryptocurrency. We’re devoted to giving you the very best news about bitcoins, altcoins, blockchain, etheriums and litecoins. Visit https://cryptotraders365.com