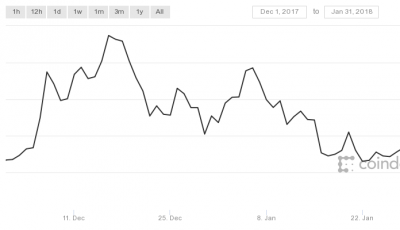

Volatility is biggest barrier to mainstream adoption of crypto, says new research

A study commissioned by decentralized stable digital currency Meter has revealed volatility is the biggest barrier to mainstream adoption of cryptocurrency.

Meter is a high performance decentralized stable virtual currency that is connected to the worldwide average competitive cost of electricity.

The study involved 1,000 American consumers who were familiar with digital currency. The research sought to find out what are people’s concerns and opinions around the technology.

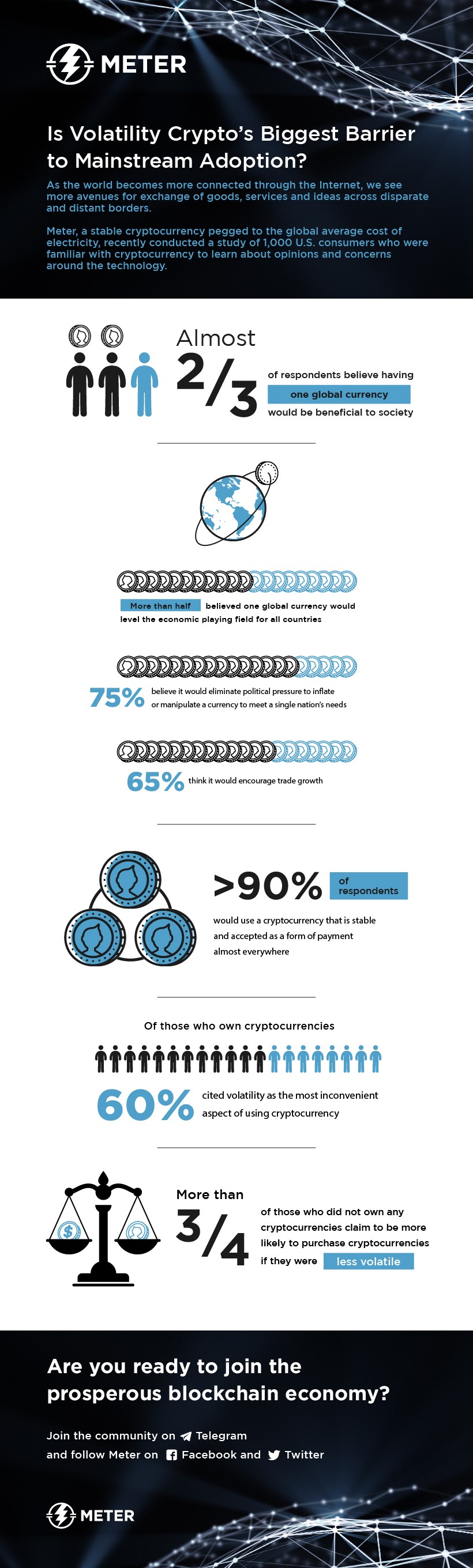

Nearly two-thirds of the people surveyed said they believe having one worldwide currency would be beneficial to society. Over half stated they are certain one worldwide currency would redress the economic balance for all nations, 75 percent said they are sure it would remove political weight to blow up or exploit a currency to satisfy a single country’s requirements and 65 percent said that in their opinion it would boost trade growth.

86 percent of respondents said they buy less than half of the things they buy with cash. More than 90 percent of the U.S. consumers surveyed said they would utilize a digital currency that is accepted nearly everywhere and is stable.

Nearly 90 percent said they are concerned about volatility, and of those who own digital currencies, 60 percent said it is the “most inconvenient aspect” of utilizing digital currency.

Nearly 50 percent of the surveyed consumers who didn’t own any digital currency cited volatility as the main reason they had not invested. Over 3/4 stated they would be more open to buying digital currencies if volatility was less of an issue.

72 percent of the Americans said they would favor a stable digital currency that could not be exploited by banks or governments. A little more than 1/3 stated they are content with the American government, and less than 1/4 said they are sure the government is ethical.

Meter CEO Xiaohan Zhu said in a press release CoinReport received from FortyThree, Meter’s PR company, “Although cryptocurrencies have garnered much hype, none exist today that function as a true currency. For example, measuring values with Bitcoin is like using a ruler made from a rubber band, its value or length stretches and contracts based on supply and demand. The digital age calls for a stable unit of account that cannot be manipulated by any one party.”

The study’s other interesting findings include:

- 82 percent of the surveyed consumers who didn’t own any digital currencies said they would like to own some in the future.

- Over half stated they had used cryptocurrencies to buy services and goods on the internet.

- Unexpectedly; swing states (57 percent), Blue (61 percent) and Red (53 percent); all said they felt tepid in their belief of the American government’s ethicality.

- 16 percent had used digital currency to buy food, 35 percent had bought gift cards and 46 percent had purchased services or goods related to gaming.

Infographic via press release we received

![[Guest Post] Major Issues Canadians Face when trying to Invest in Crypto](https://coinreport.net/wp-content/uploads/2018/12/CoinSmart-co-founder-CEO-Justin-Hartzman-400x230.jpg)