Moonshot: The Redux

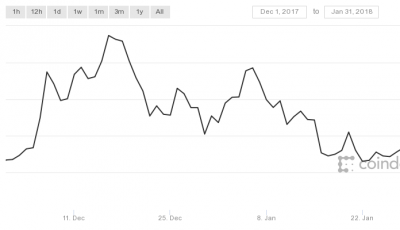

Nothing excites the bitcoin community like price predictions, especially when the inescapably optimistic predictions look to be coming good. Recently, the rainbow charts and trend analyses have shot skyward, causing “traders” and “experts” to recalibrate their mathematical and astrological prediction schemes even higher. The year 2016 was rough for bitcoin, and cryptocurrency in general. Lower attention, investment, and many business failures contributed to a stagnant ecosystem. The rise in bitcoin value is a welcome shot in the arm for the bitcoin community, which will go into 2017 with renewed optimism.

Nothing excites the bitcoin community like price predictions, especially when the inescapably optimistic predictions look to be coming good. Recently, the rainbow charts and trend analyses have shot skyward, causing “traders” and “experts” to recalibrate their mathematical and astrological prediction schemes even higher. The year 2016 was rough for bitcoin, and cryptocurrency in general. Lower attention, investment, and many business failures contributed to a stagnant ecosystem. The rise in bitcoin value is a welcome shot in the arm for the bitcoin community, which will go into 2017 with renewed optimism.

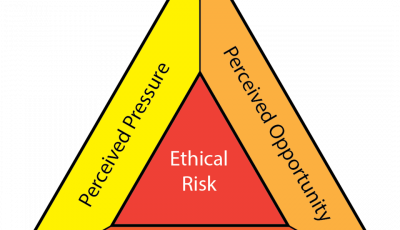

For all the talk about upsetting the order of things, and creating a system outside government control, bitcoin believers tend to really only care about bitcoin as an investment. Specifically, as their personal investment vehicle. Other than not wanting to admit to it, there’s certainly nothing wrong with the self-interest shown by the bitcoin community. Though the tendency to go overboard and actively root for the demise of the entire economy of places like Venezuela, India, and the Euro Zone is prevalent, the personal attachment to the success of bitcoin is what has kept so many users engaged with the digital currency. Through hacks, scams, exits, thefts, and loss of general interest, many bitcoin believers have stuck by their cause. For long-time users, the rise in price is taken as vindication of what they’ve been preaching about.

The cause of bitcoin’s rise in value is unclear, leading to broad speculation. As with other price fluctuations, the price of bitcoin is often correlated to capital flight in China, government policy changes in places like Greece, Venezuela, India, and the U.S., or simply broader public involvement when bitcoin achieves market penetration in a new region. These connections are tenuous at best, furthering the speculative nature that bitcoin has taken on. The lack of data available on bitcoin valuation means that no one can definitively explain why bitcoin behaves the way it does, but this also means no one can disprove a claim about bitcoin. Bitcoin is up because of China! You can’t prove I’m wrong. India? The Fed? Evil Bankers? I don’t know, and neither do you, so a claim is just as valid as a claim that I’m wrong. Compounding this difficulty is the insinuation that anyone speaking negatively must be a “shill.” The resulting echo chamber is less than rational.

The speculation about bitcoin prices has fed into the political motives of many in the bitcoin community, creating a “news” industry that reports price movements as products of what bitcoin believers prefer to hear: The economic order is failing, governments are failing, and people are moving into bitcoin as a safe shelter. Of course none of this is objectively accurate, and is completely and consistently unsupported. But in this era of post-truth and fake news, sites like ZeroHedge have captured an audience that would rather believe their fake news than be forced to accept reality.

Regardless of the nature of bitcoin price claims, the fact that the price of bitcoin is up massively in 2016 has created a new buzz around the digital currency. This is good news for the investors, users, believers, and technologists who have each invested in their own ways, buying into the bitcoin narrative. The year ahead could prove to be the year that bitcoin is reinvigorated, perhaps capturing some of the magic of previous bitcoin bubbles and this time achieving greater adoption. Rather than focusing on consumer-facing products, the settlement ability of the blockchain could become the impetus for greater usage. A user is a user, whether as a single consumer or a bank needing a settlement layer. The promise of bitcoin remains unfulfilled, and for that reason alone, here’s to hoping that 2017 brings renewed optimism in the bitcoin space!

Image credit – Public domain image by Satoshi (Source)