Less Than Impressive: 21 Inc.

Unless you’ve been living under a rock you’ve likely heard of 21 Inc., one of the biggest stars in the bitcoin ecosystem. The recent launch of their flagship hardware product, which acts as a miner when used in conjunction with any networked computer, was supposed to herald a major step forward for bitcoin and the much talked about “internet of things.”

Unless you’ve been living under a rock you’ve likely heard of 21 Inc., one of the biggest stars in the bitcoin ecosystem. The recent launch of their flagship hardware product, which acts as a miner when used in conjunction with any networked computer, was supposed to herald a major step forward for bitcoin and the much talked about “internet of things.”

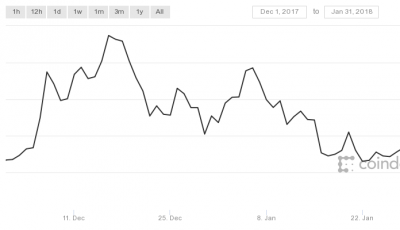

Proponents of bitcoin see the digital currency as a natural fit for an internet of connected devices; a machine language currency acting as the medium of exchange between machines. It’s an intuitively appealing idea, with an implied benefit to the price and stability of bitcoin. Though bitcoin believers will aggressively deny that their main motivation is monetary, the intense focus on initiatives that will benefit the bitcoin price betrays their primary motive: having lots of dirty, statist, fiat dollars.

The enthusiasm for 21 Inc. was seemingly well-placed. The firm raised over $120 million from venture capitalists to develop hardware, a notable difference from many bitcoin firms that targeted softer revenue streams like banking services, remittance and trading/arbitrage. The culmination of technical development in a potentially disruptive market fueled by ample financial backing was the release of 21 Inc.’s mining chip. Here’s a highly technical explanation of what went into this highly advanced piece of technology, backed by millions of dollars in research and development: A Raspberry Pi 2, a USB cable, and some custom Linux.

New owners of this cutting edge Raspberry Pi, errr 21 Inc. chip can now mine their own slice of the bitcoin pie, earning Satoshis just by leaving the power on. But wait, there’s more! It turns out users don’t actually get the bitcoins they mine. Instead, 21 Inc. owns the mining pool that all these mining chips contribute to, and will then return some of the mining proceeds to the miners. This is quite a deal for owners who are essentially subsidizing 21 Inc.’s mining pool through their own electric bill, paying for the privilege of owning a less than cutting edge piece of mining hardware.

In defense of 21 Inc. the buzz behind them may have set expectations too high, and the need to be first to market may have pushed the company to release a product sooner rather than later. It’s also no secret that developing hardware is very capital-intensive, something that a VC-funded start-up would struggle with if they lack significant cash flow. It’s also understandable that a start-up will struggle with releasing polished products, especially in such a dynamic business environment. It is less understandable that their first product to market is a poorly disguised attempt at selling lackluster technology to a technically proficient user base. I can’t speak for them, but if I were a VC I may be asking some tougher questions about when I’m getting my $120,000,000 back.

Image credit – Public domain image by Satoshi (source)

Yeah, nobody’s making ANY money from a 21 inc. device. If you want to invest in bitcoin, just buy some at http://bit.do/Coinbase or whatever is available to you locally, http://bit.do/buybtc if nothing else.

It’s very disappointing!