Abra announces early access registration to world’s first global investment app

Mountain View, California-headquartered Abra announced in a press release CoinReport received from Spark, Abra’s communications firm, early access registration to its and the world’s first global investment smartphone app.

Mountain View, California-headquartered Abra announced in a press release CoinReport received from Spark, Abra’s communications firm, early access registration to its and the world’s first global investment smartphone app.

The industry first opportunity allows investors from more than 155 nations to invest in conventional ETFs and stocks, alongside over 30 digital currencies and 50 fiat currencies, all within one app.

Abra claims this is the next step in its vision to utilize the programmable money features enabled by the bitcoin blockchain to build and democratize new financial services and products for all and sundry all around the world.

A 2018 report from the Credit Suisse Research Institute revealed that half of the world’s population owns less than one percent of all global wealth, while just 10 percent of the people in the world own 85 percent of global wealth, and over half of that wealth is concentrated with just one percent of the global population. It may be noted here that the institute’s report defines “wealth” or net worth as the value of financial assets plus real assets (principally housing) owned by households, minus their debts.

The same ownership inequality holds true for investments also, as 84 percent of all stocks owned by Americans belong to the wealthiest 10 percent of households (National Bureau of Economic Research via NY Times, 2018).

Abra CEO Bill Barhydt

Abra CEO Bill Barhydt said in the news release we received, “Investing in stocks can be a daunting, complex and decidedly exclusionary activity. We are building Bitcoin-backed investing products because, for the first time, we can truly democratize access to investment opportunities at global scale. It shouldn’t matter where you live or how much you earn to be able to make investments and participate in capital markets. We’re excited to allow anyone to start investing in global equity products and take control over their savings.”

The app offers fractionalized investment model and $5 minimum per investment. In the early access program, users registering for the service during pre-launch will benefit from zero trading fees for the rest of 2019 on ETF and stock investments. Like a fraction of a bitcoin can be owned, fractions of high-priced ETFs and stocks can also be owned soon using Abra.

During the preliminary rollout, Abra will offer 50 new investment assets, including stocks like Apple, Amazon, Facebook, Google, Netflix, commodities such as SPDR Gold Trust, ETFs like the S&P 500 and Vanguard Growth, and indexes such as the Russell 2000, and more.

Abra is a non-custodial platform, unlike wallets or digital currency exchanges that operate like conventional banks. It means the app doesn’t collect, store or have access to user funds, which are stored on the bitcoin blockchain, making the transactions more private and secure compared to centralized databases that most wallets and digital currency exchanges use.

A new investment model called Crypto Collateralized Contracts, or C3s, is used for investments in the Abra platform. C3s enable an investor to effortlessly get investment exposure to any asset, like another digital currency, a bond, or stock, etc., by using smart contracts and bitcoin as the underlying tech for the investment.

C3s allow investors to rapidly and economically switch between various types of asset classes and investments without the requirement to move money across several platforms or between wallets. The investment model’s programmable nature enables Abra to peg anything’s value with a dependable price feed to bitcoin’s value. C3s are thus like stablecoins. Abra makes this work by hedging its side of the contract so that users are able to be made completely whole on their investment at any time no matter the direction of the market.

The model’s net effect translates to Abra offering investing with low fees in fractional share increments with almost instantaneous settlement times.

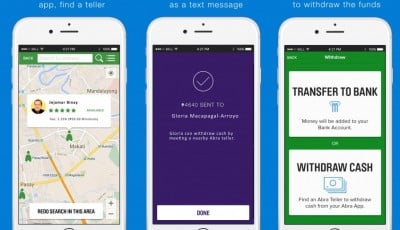

The Abra app can be downloaded from Apple Store and Google Play. Once downloaded, users can set up an account with Abra. From there, they can finance the app using wire transfers, credit cards or other digital currencies to get started. As soon as the Abra account is funded, users can begin investing in any supported assets.

Images via Press page on Abra’s website