[Guest Post] Monero: A Model for Decentralized Governance

by Matt Godshall, editor in chief at Unhashed.com

Few cryptocurrency leaders have had as short of a tenure as Thankful_for_today. The BitcoinTalk forum user debuted his new cryptocurrency on April 18, 2014. He proceeded to then alienate the core community members so thoroughly that just 5 days later, on April 24, they decided to fork the project and start their own coin without him. The original coin—which you’ve likely never heard of—was called bitMonero. The fork, of course, is Monero.

It’s a fitting origin for a coin that has always had a unique approach. For those unfamiliar with the project, Monero is the largest privacy-focused cryptocurrency in the world and currently the 13th most popular cryptocurrency by market cap. Today, roughly 4 years after its inception, Monero continues to buck the trends followed by many other coins, particularly in their innovative systems for decentralized governance.

With the recent announcement that longtime project maintainer Ricardo “fluffypony” Spagni will be reducing his role on the platform, we’ll take the opportunity to examine Monero’s governance protocols and how Monero exemplifies decentralized governance in cryptocurrencies.

Aren’t All Cryptocurrencies Decentralized?

Perhaps the second-most popular buzzword associated with cryptocurrencies (behind “blockchain”) is “decentralized”—and for good reason. Decentralization is generally regarded as the driving ideology behind cryptocurrencies: stepping away from traditional financial structures, eschewing trusted third parties and eliminating central points of failure. But in practice, cryptocurrencies have applied decentralization with varying degrees of success. Many succeed in creating a decentralized network of nodes and miners which serve to validate transactions without a trusted intermediary—meaning that the platforms themselves are decentralized. At the same time, however, they remain largely centralized from a governance perspective.

Many cryptocurrencies do not look very different from traditional companies. Often there is a charismatic leader—Ethereum’s Vitalik Buterin, TRON’s Justin Sun, etc.—and a clear hierarchy descending from the top. The leader sets the course, undoubtedly with consultation from other team members, and the rest of the team works to realize that vision.

These centralized organizational structures stand in stark contrast to community-driven cryptocurrencies like Bitcoin and Monero. Bitcoin founder Satoshi Nakamoto is a near-mythological figure—gifting the world with Bitcoin and the blockchain before disappearing into the ether. Satoshi’s disappearance required the Bitcoin community to self-organize in order for Bitcoin to continue growing and improving, which is exactly what the community has done. Over 500 volunteers have worked on Bitcoin to make it what it is today.

Monero followed a somewhat similar path. Following the ousting of Thankful_for_today, community members with names like tacotime and smooth took control of the coin. The platform was open source and community driven from the outset. Anyone who wanted to participate in the coin’s development was encouraged to, even if they didn’t know how to code; the community would find something for them to do.

Monero has seen contributions from at least 223 individuals in the last 12 months, working on everything from the platform’s privacy algorithms to their website and social forums. While the development community is less than half the size of Bitcoin’s in absolute numbers, it’s an impressive amount of community involvement considering the Monero market cap is 40-times smaller than Bitcoin’s.

The Monero Core Team: Working Oneself Out of a Job

This is not to say that there is absolutely no hierarchy in Monero, but it is a surprisingly loose structure. The Monero Core Team consists of seven individuals, most of whom are anonymous outside of their online tags. A recent community post put in explicit terms what the Core Team is responsible for:

The responsibilities of the Core Team are as follows (in no particular order):

- Act as primary trusted arbiters of the Forum Funding System on behalf of the community, so as to ensure the completion of all projects to the satisfaction of the community.

- Manage the codebase of the Monero Project, which includes merging code on Github, keeping backups, and ensuring the safety, security, and free access of the code from any party.

- Steward the general donation fund, and spending the Monero there on anything they see fit to further the Monero Project.

- Act as trusted signers and distributors of reference clients for the Monero coin, and other related technologies.

- Set a direction and vision for the Monero Project

They also describe what they are not responsible for:

- Members of the Core Team are NOT anyone’s boss, and no permission is needed from them to do anything.

- The Core Team does NOT act as a centralized point of failure, but encourages organic, self-started initiatives that further the ecosystem of Monero.

- The Core Team does NOT equal Monero. In the event that one, or all of the Core Team goes rogue, we are to remember that Monero is a movement. A global initiative to further privacy globally, and provide real, fungible, digital money for everyone. This can happen even without the presence of the Core Team.

The Monero Core Team therefore acts primarily as stewards of the coin rather than all-powerful leaders. They seek to steer Monero in the right direction, but ultimately the community decides what improvements are necessary for the project.

The lead maintainer and controversial face of Monero for nearly four years has been Ricardo Spagni, aka fluffypony. Spagni has long considered himself somewhat of a reluctant leader. In a recent interview, he described that his goal with Monero was essentially to work himself out of a job.

“I want to make sure that I have less and less of an active role. And instead of passing the baton to one person, the batons are being cut into small pieces and passed on to many people.” He continued, “What’s the point of claiming to be community driven and then still trying to centralize around individuals?”

A man of his word, Spagni officially announced on May 27 that he has begun phasing himself out of hands-on roles on the Monero development team and will be transitioning to a more advisory position.

“. . . over the past year I’ve been reducing my roles within the Monero project itself, in order to ensure I am never a bus factor,” Spagni said. “I am determined to further reduce any reliance on me over time by continuing this trend, with an eventual goal of handing off the task of lead maintainer. . .”

This move is intended to free Spagni up to work on his new project, called Tari, which is a decentralized asset management protocol that will be built on top of Monero. As Spagni steps down from his roles on the Monero project, other members of the Monero community will have to step up to fill the positions he leaves vacant.

The Benefits and the Problems of Decentralized Governance

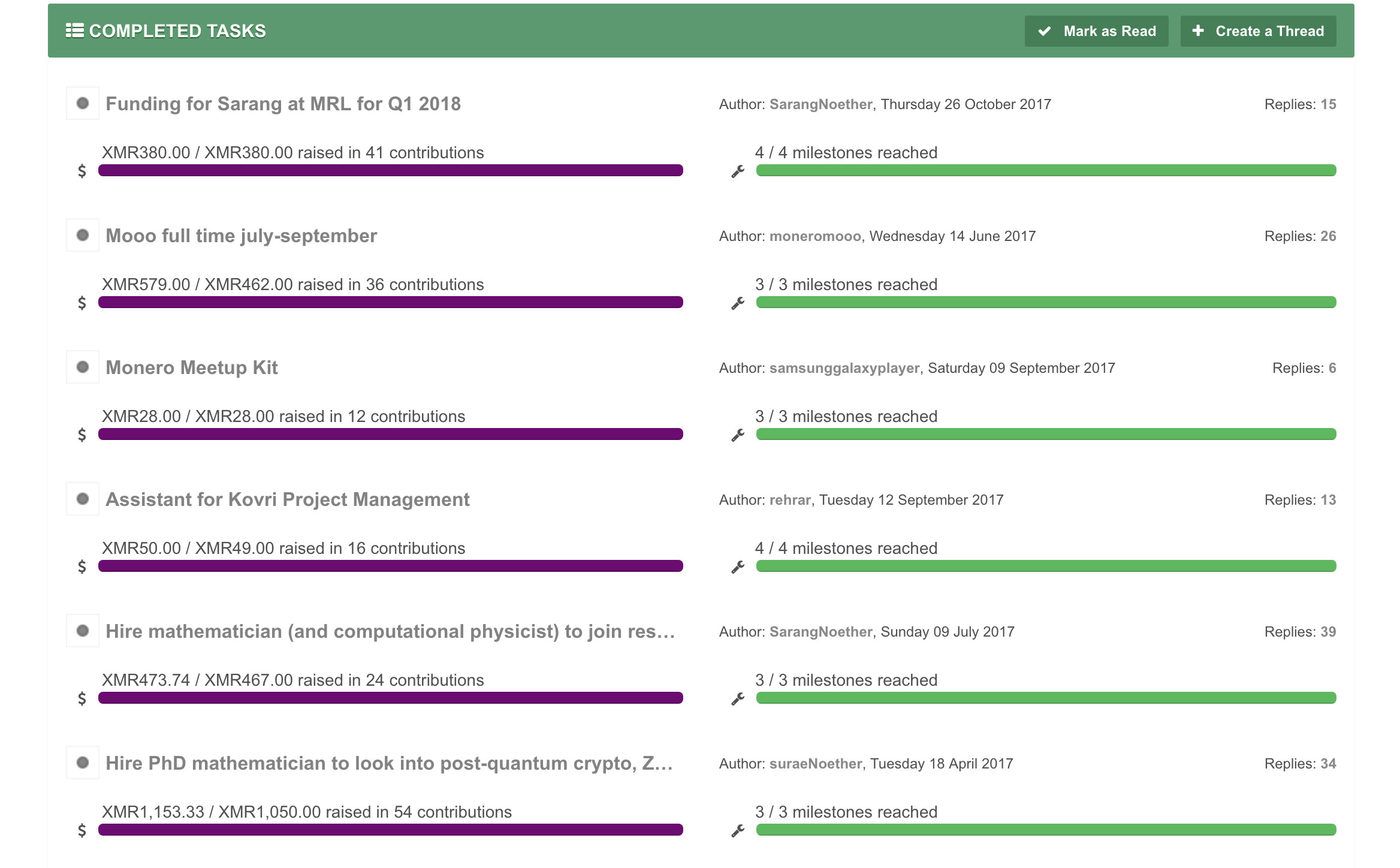

Monero’s community-driven ethos brings with it a range of benefits as well as problems. The most prominent advantage is that everyone in the Monero community has a very real say in the direction of the coin. Community members who want to pursue a project are given every opportunity to do so. This is facilitated by Monero’s innovative Forum Funding System, in which ideas can be pitched, iterated-upon, funded, and monitored by the community. Monero has a huge archive of tasks that have been completed through this process.

Monero’s decentralized structure also provides it with what Larry Sukernik calls “sovereign-grade censorship resistance”. For a privacy-focused project like Monero, it is not enough that the network is decentralized. The project benefits from having a loose organizational structure as well, because it makes the platform less vulnerable to governments, censors and malicious actors. Decentralized organization means that there are fewer attack vectors through which Monero’s integrity could be compromised.

Monero’s decentralized structure also provides it with what Larry Sukernik calls “sovereign-grade censorship resistance”. For a privacy-focused project like Monero, it is not enough that the network is decentralized. The project benefits from having a loose organizational structure as well, because it makes the platform less vulnerable to governments, censors and malicious actors. Decentralized organization means that there are fewer attack vectors through which Monero’s integrity could be compromised.

At the same time, the decentralized community approach also has several drawbacks. For one, centralized organizations are better at adapting to changing industries. If a crisis hits, Monero could have a hard time making the necessary adjustments to remedy the problem in a timely manner. Community disagreements could also arise regarding the future of the project, the worst of which might result in a hard fork of the community into two separate coins. These are issues that centralized organizations with more rigid governance structures may be less likely to experience.

Conclusion

The tradeoffs associated with decentralized governance systems are significant, and not all projects will benefit from a decentralized structure. More and more, however, it seems that cryptocurrencies are moving toward more centralized organizational structures, and I am not sure if the cryptocurrency community fully appreciates the risks of this move. Monero, for their part, seem willing to accept the potential downsides in exchange for what they gain: a truly community-driven, censorship-resistant platform. Given the importance of decentralization as a foundational principle for cryptocurrencies, it may be valuable if more coins consider this approach.

Disclaimer: The author of this article owns a small holding in various cryptocurrencies, not including Monero. The information in this article is based upon current available data and the author’s views as of June 11, 2018, all of which are accordingly subject to change. The above article should not be considered investment advice. Any such advice or opinions should be sought by an independent, third-party expert over such matters.