ICO Woes

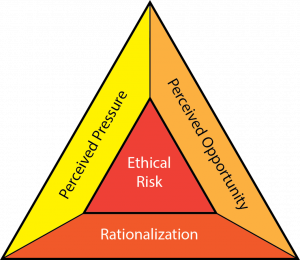

The Fraud Triangle or Compromise Triangle was first proposed in 1951 in the article “Why Do Trusted Persons Commit Fraud? A Social-Psychological Study of Defalcators” in the Journal of Accountancy by Donald Cressey and Edwin Sutherland. This was later researched by a team from KPMG and the term “Fraud Triangle” was coined by one of the researchers, W. Steve Albrecht, Ph.D., CFE, CPA, CIA. This visualization of the Fraud or Compromise Triangle is DavidBailey’s work.

If you received an email from a Nigerian prince offering to double or triple your investment for some obtuse reason, perhaps his inability to move the funds out of his bank, most reads would presumably, promptly delete the email and mentally check it off as a scam. If, however, the email instead stated that a new Initial Coin Offering was in the works and YOU, yes YOU, can get in on the ground floor of this unregulated and destined to succeed asset to double or triple your money, it seems lots of bitcoin believers would choose to invest. The word invest implies some element of due diligence, though, so perhaps the better word for describing this economic activity is simply betting. Betting on ICOs has proven to be a very mixed experience, and with pressure from governments now being felt, the future of ICOs seems bleak.

Stock markets are generally regulated. This is for a variety of reasons, mostly government interest in maintaining stability and investors interest in access to transparent trading records. Because many cryptocurrency exchanges are not regulated, the faults of unregulated, or dark, exchanges are apparent to traders in the risk they assume simply by moving funds to the exchange. Trading can often become gambling, since the order book has no audits and the exchange can simply move prices up or down to close positions, resulting in losses for traders and profits for exchanges. This flaw in the cryptocurrency ecosystem has prompted many users to jettison exchanges in search of economic gains elsewhere.

This is partly why the rise of ICOs has been so spectacular. Many speculators in the cryptocurrency space are unable to cash out, as the amount of actual money invested in digital assets is massively less than the claimed value of digital assets. Simply put, there are not nearly enough buyers for all the would-be sellers. This has led to some over-the-counter (OTC) firms to provide niche services to large clients, but those firms operate in the regulated world. For holders of many digital assets who operate in the grey or black markets, and achieved their gains through unreported means, cashing out is not exactly possible. Without a doubt, someone who possesses a large amount of bitcoin can slowly convert their gains into dollars on sites like Localbitcoin or other ways of contacting sellers and slowly, methodically, trading bitcoin for cash. This is inherently risky, however. This type of activity leaves a trail. It also requires face to face meetings, ill-advised for mega-criminals trying to go legitimate. So how does a well-to-do recently retired from the game purveyor of powerful opiates exit the digital asset trap? Diversifying assets and bartering.

Moving out of bitcoin and into less-traceable coins like Monero enables further hiding and puts a user in contact with many other like-minded privacy conscious individuals. Spreading bitcoin amongst assets like Monero, Ethereum, Litecoin, and various altcoins acts as somewhat of a hedge against disaster, though the market has displayed a tendency to follow bitcoin up or down. Or, perhaps at this point they are following Tether’s ability to prop up bitcoin. Either way, this strategy isn’t enough. So why not buy a short-lived asset that can be rapidly offloaded at a promised increase? The ICO for early buyers is a quick way to increase the face value of their digital assets, and is another easy, untraceable way for digital millionaires to diversify their portfolio. For the discerning darknet investor, a diverse group of holdings easily transferable to any non-extraditing nation is key to future luxury.

The issue now arising is the interest of governments in curtailing the outright fraud that exists in many ICO promises. Perpetrated on an often naïve crowd, ICOs capture the excitement of the moment to acquire valuable assets in exchange for less than assured assets, a new coin that will supposedly derive value from some underlying technology or property. As entities like the SEC ramp up investigations of this process, though, investors may find their digital anonymity threatened by regulators, driving these skittish types to new fringes of digital asset investing. As the ICO craze concludes, the next wave of digital investing will have to fill the gap. Whoever figures out the next best way to launder ill-gotten digital assets and capture the enthusiasm for subverting the traditional banking system will stand to benefit massively. As long as they don’t HODL too long, that is. Paper profits are only so useful, even when you’re fighting The Man.

Image credit – DavidBailey (CC BY-SA 4.0)