Ashes to Ashes

It’s a storyline that participants in the cryptocurrency ecosystem have encountered too many times: Bitcoin stolen from users. This time the target was Bitfinex, an exchange among the oldest in the bitcoin ecosystem, an achievement given the number of flops and hacks. The story of the hack is interesting for the dollar amount lost, but also for the manner in which the exchange managed the loss. Bitfinex users will share the loss with a bail-in, taking a “haircut” to spread the losses. Or, another way to express it, socialize the loss. How can a movement that dedicates itself to removing government safety nets and governmental control embrace this ideological mismatch?

It’s a storyline that participants in the cryptocurrency ecosystem have encountered too many times: Bitcoin stolen from users. This time the target was Bitfinex, an exchange among the oldest in the bitcoin ecosystem, an achievement given the number of flops and hacks. The story of the hack is interesting for the dollar amount lost, but also for the manner in which the exchange managed the loss. Bitfinex users will share the loss with a bail-in, taking a “haircut” to spread the losses. Or, another way to express it, socialize the loss. How can a movement that dedicates itself to removing government safety nets and governmental control embrace this ideological mismatch?

The hack on Bitfinex emptied around $72 million worth of cryptocurrency, primarily bitcoin. Though the technical details have yet to be published, this is another blotch on what has been hailed as a transformative technology. Exchanges have served as an effective mechanism for bitcoin users who are seeking ways to capitalize on their assets, and represent some of the few venues where users who possess bitcoin can redeem them for regular currency. This important conduit has had a centralizing effect, exposing a community built on decentralization to significant risk. The Bitfinex losses are further evidence of the risk that bitcoin users assume when participating in the ecosystem, but unlike traditional financial institutions, there is little insurance against disaster.

In the wake of such a disaster, Bitcoiners accepted the first solution offered, and haven’t asked for transparency. This may partly be due to how the Bitfinex hack has been handled relative to other hacks and exit scamers; 36% seems like a bargain for a user base typically exposed to 100% losses. Accepting a haircut seems, in comparison, to be reasonable, but creates a false dichotomy: maintain 0% of your balance or 74%. The standard has been set so low within the bitcoin community, which intentionally lacks any regulatory underpinnings or safety nets, that any retained value above 0% seems good! It is interesting, then, that the community has self-regulated, favoring not their political views, but instead a pragmatic safety net.

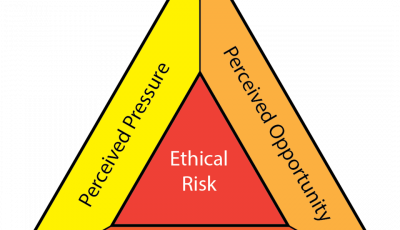

Among the fundamental purposes of bitcoin is creating and promoting trustless, transparent forms of exchange. But users have entrusted their assets, and now the investigation and repayment of lost assets, to a central authority that is both completely opaque and unverifiable. What is the total amount of deposits held by Bitfinex? Are audits conducted on reserves to verify their existence? Is this another fractional reserve situation? Why is 36% the loss that users are socializing, and why are all users bearing equal burden? The often over the top libertarian and anarchist crowd that promotes bitcoin as an alternative to the status quo completely capitulated their ideology in the face of financial loss. What gives?

This phenomenon be expressed simply: Virtue untested is no virtue at all, and when tested the bitcoin faithful have failed. Changing the world is a siren call, attracting a crowd that nominally claims to support dramatic change. As I’ve claimed before, and adamantly believe, bitcoin believers can be more accurately described as believers in financial gain through what they perceive to be easy, and accessible means. The Bitfinex haircut should be a reality check for the bitcoin community, and hey, it only cost 36% of your bitcoin….what a steal!

Bravo…. People really need to know the dynamics of both cryptocurrencies and the hard truth of our current banking systems…. Prior to bitcoin owners tethering this wealth to wall street banking firms, the coins were NEVER Hacked, Never Stolen and Never Lost. These Owners placed faith and trust in a system that Bitcoin was created and designed to protect its investor from. Today we see the same banking system creating their own cryptocurrencies to market. But in reality these coins will be as secure as our current system is today, riddled with fraud and abuses. Yet people will flock with fistfuls of cash to get involved on the promises of greater wealth…. One thing wall street is known for are BUBBLES POPPING….. I can see the bubble forming today. Investors need to know their coin (cryptocurrency).

In the simplest of terms, cryptocurrencies are designed and created to be a stand alone payment system outside the reaches of the reckless banking systems and the Lets print more Dollar Governments. Thanks to Bitcoin this concept has proven in many ways that it not only can retain its value but can increase in wealth. So much so, the US Federal Courts ruled Cryptocurrencies are commodities, just like gold and silver. Cryptocurrencies is the future, there is no doubt about this.

What will make cryptocurrency realized as an everyday go to payment system is three things.

1st: A large number of coin owners (today there is only one cryptocurrency being marketed with over 2.1 million members/coin owners) and this number is growing and less than three years old.

2nd: Real security measures built into each coin mined. This cryptocurrency identifies each coin mined to an individual directly in its blockchain as its created. So if it is ever hacked, stolen or lost it can be returned intact to its rightful owner. In addition by Identifying each coin as its mined it eliminates money laundering schemes and illegal enterprises such as Identity theft. This is one of the best consumer protection plans ever designed. Merchants will see vast reductions in banking fees by accepting it and virtually no fraud that is currently implanted in today’s system.

3rd: it must remain outside of our current banking systems, this is very important. For two reasons. If (or shall I say when) there is another market crash or even worse a monetary crash. this system will not be directly impacted by the crashing market. Remember Cryptocurrency is a Commodity now, its like having gold or silver in your hands. Cryptocurrency offers Citizens an option for their economies. Think back to the market crash of 1929. There was nothing in place for citizens to use in order to continue with a functioning economy or commerce. This is why factories and mom and pop stores closed all across the nation. And each Citizen was held helpless unless they held something of value. In today’s economy it is the Citizens that is the driving force that is holding up the current system in place, even though they have absolutely no control over both the banking system or governments monetary policies. This is the real beauty of cryptocurrency, it provides for the citizen a means of continuing to conduct their economies and everyday transactions even as the current system is crashing at their feet.

If you want to see the only cryptocurrency that is solving and correcting all the issues faced by Bitcoins owners, then drop me and email [email protected] you’ll be happy you did. Information is power folks…. just look at it.