Gemcoin not legitimate, receiver report finds

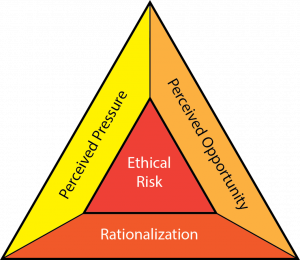

The Fraud Triangle or Compromise Triangle was first proposed in 1951 in the article “Why Do Trusted Persons Commit Fraud? A Social-Psychological Study of Defalcators” in the Journal of Accountancy by Donald Cressey and Edwin Sutherland. This was later researched by a team from KPMG and the term “Fraud Triangle” was coined by one of the researchers, W. Steve Albrecht, Ph.D., CFE, CPA, CIA. This visualization of the Fraud or Compromise Triangle is DavidBailey’s work.

According to a new report on California-based United States Fine Investment Arts (USFIA), there is no indication that there was any legitimate Gemcoin or other viable business operated by the company, which marketed a digital currency it claimed to be “intrinsically backed” by mines worldwide.

The report, produced by court-appointed receiver Thomas Seaman, said that rather than finding amber mines around the world, the receiver uncovered only “costume jewelry, boxes of rocks and bins filled with tens of thousands of little rings of nominal value,” reported the Pasadena Star-News.

Last fall, federal law enforcement raided USFIA’s corporate offices in Arcadia, California. The Securities and Exchange Commission laid fraud charges against the company, its CEO Steven Chen and a dozen of other enterprises he controls.

At that time, reported the Star-News, assets were frozen in 48 bank accounts connected with Chen. The bank accounts are now under the control of the receiver, whose mandate is to recover and redistribute as much of the alleged stolen funds as possible.

The newspaper reported that as of December 31, 2015, the receiver has recovered nearly $22 million in investor funds and identified 32 additional entities, both in the U.S. and abroad, that are connected to or owned by Chen.

According to the report, the entities had “no significant source of income other than money raised from investors.”

Attorney Long Z. Liu, who filed a $100-million class action lawsuit on behalf of thousands of investors, told the Star-News that the report provides sufficient evidence to demonstrate the entire operation was a scam.

“Before it was just speculation, but now we have concrete evidence to show where the money went and how it was transferred,” said Liu to the newspaper. “All of these companies were set up to defraud investors and to hide the money.”

The report states that due to the volume of electronic data and the disorganized manner in which it was maintained, the receiver has not yet been able to identify the full scope of the USFIA enterprise, the number of investors, or specific amounts invested by investors or distributed to them.

The Star-News reported that among the defendants in the class-action lawsuit is former Arcadia Councilman John Wuo, who resigned last fall amid intense scrutiny over his endorsement of Gemcoin and Chen.

His resignation followed allegations made by several Chinese-Americans who said Wuo convinced them to invest in Gemcoin because of his position as a government official. Wuo’s name and picture appeared on several USFIA-affiliated websites and in marketing materials produced by the company.

Liu told the Star-News that the case has been culturally damaging because three of USFIA’s executives are Chinese.

“Now, some people think Chinese people cannot be trusted because we are tricky or manipulative,” Liu said. “It’s like the saying goes, ‘a bad apple ruins the whole bunch,’ so everybody gets affected by this.”

Image credit – DavidBailey (CC BY-SA 4.0)

So now what happens to Gemcoin. Thxs