Dogecoin, Block Times, and Security: Do the Altcoins Have It Right?

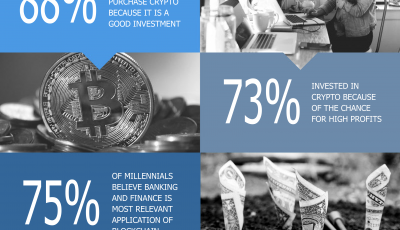

Many of the so-called “Altcoins” that have followed in the footsteps of Bitcoin have differentiated themselves through the use of shorter block times. Bitcoin, which has historically used a block time of ten minutes, self-regulates the network to ensure that, on average, a new block is produced six times per hour. Altcoins like Dogecoin and Litecoin, in contrast, produce new blocks around every one and three minutes, respectively.

On the face of it, this seems like a major advantage for those cryptocurrencies: If you simply intend to wait for the first confirmation of a transaction before you move on, one minute is a lot more feasible than ten minutes for day-to-day brick-and-mortar store purchases. However, the value proposition is, unfortunately, a good deal more complex.

It’s worth taking a moment to note that the total hashing power behind the Bitcoin network isn’t dictated by the number of blocks per hour – it’s dictated by the economics of mining rewards and transaction fees. Increasing the block rate by a factor decreases the security of an individual block by a corresponding factor. Plus, it’s generally agreed that for significant transactions, it’s better to wait for five or six blocks to pass in order to render your transaction genuinely irreversible (barring a 51% attack). For those sorts of secure transactions, reducing the block time only increases the number of blocks you have to wait in order to get the same guarantees of security.

Worse, reducing the block time can actually compromise the total efficiency of the network: Shorter block times increases the likelihood that more than one miner will generate a valid block solution at the same time. Naturally, only one of these blocks can become part of the final, historical block chain – the rest become what are called “orphan blocks,” and any transaction history that happens in them are disregarded by the network, and the hashing power spent on them doesn’t contribute to the overall security of the network. For very short block times, the total hit to the security of the network can be substantial.

That said, executing a successful double-spend attack on even a single-confirmation Dogecoin purchase is non-trivial. You need to control a significant fraction of all the hashing power in the network in order to even have a plausible chance at beating the network to the block. For the situations in which very short transaction times would be useful (small, in-person purchases), the cost of having someone execute the purchase is likely to exceed the potential profit on your $50 grocery store bill, for anything other than total dominance of the network’s hashrate. The economics of the attack simply do not exist – and, of course, in an online or large-transaction scenario, you can simply wait for a reasonable number of transactions to pass, as latency is less of an issue.

In short, high-blockrate cryptocurrencies like Dogecoin and Litecoin have traded off some degree of protection against 51% attacks in exchange for quicker turn-around on some minimum degree of security needed to make small transactions. Whether or not this is a worthwhile tradeoff is left as an exercise to the reader. However, one thing to take away from this is the possibility that there may be room for more than one mainstream cryptocurrency, one with relatively slow transactions that makes a good source of value, and one with relatively fast transactions, that makes a good liquid currency for rapid, in-person purchases, and both of which provide value to the user independently.

![[Guest Post] Will Blockchain Help Streamline Data Management?](https://coinreport.net/wp-content/uploads/2019/01/Rae-Steinbach-400x230.jpg)